just-studio.ru Community

Community

How Much Body Fat Can I Lose In 6 Weeks

The American Council on Exercise asserts, though, that you can safely and successfully plan on losing about 1 percent of your body fat per month. Lose Up to 15 Pounds of Fat and Gain Lean Muscle in Just 6-Weeks! We You've tried every diet out there but can't slim down or lose stubborn belly fat. 20 lbs or 5% body fat in 6 weeks is certainly a challenge, but it isn't fitness, that isn't healthy. That being said it's definitely possible. The aim is for a 1% body weight loss each week. However, in the first few weeks, you can lose up to % per week. Let's look at how we do this specifically. Intense exercise times/week Generally, some fat intake, particularly intake of unsaturated fats, can have beneficial effects on the human body. There are lots of ways you can lose weight, from making small changes to what you eat and drink to finding more support. If you're overweight, losing weight. Here's the good news: “Assuming you're already pretty healthy, hovering between 15 and 20 [percent body fat], you can realistically dump 1 to 3% in a week,". People who are very overweight (men over 25% body fat and women over 35%) can often lose 2-to-4 pounds per week without issue. That means very overweight people. A healthy rate for reducing your body fat is about 1 to 3 percent per month, but rates vary widely depending on gender, age, body type, etc. The American Council on Exercise asserts, though, that you can safely and successfully plan on losing about 1 percent of your body fat per month. Lose Up to 15 Pounds of Fat and Gain Lean Muscle in Just 6-Weeks! We You've tried every diet out there but can't slim down or lose stubborn belly fat. 20 lbs or 5% body fat in 6 weeks is certainly a challenge, but it isn't fitness, that isn't healthy. That being said it's definitely possible. The aim is for a 1% body weight loss each week. However, in the first few weeks, you can lose up to % per week. Let's look at how we do this specifically. Intense exercise times/week Generally, some fat intake, particularly intake of unsaturated fats, can have beneficial effects on the human body. There are lots of ways you can lose weight, from making small changes to what you eat and drink to finding more support. If you're overweight, losing weight. Here's the good news: “Assuming you're already pretty healthy, hovering between 15 and 20 [percent body fat], you can realistically dump 1 to 3% in a week,". People who are very overweight (men over 25% body fat and women over 35%) can often lose 2-to-4 pounds per week without issue. That means very overweight people. A healthy rate for reducing your body fat is about 1 to 3 percent per month, but rates vary widely depending on gender, age, body type, etc.

How to lose weight in 6 simple steps · 1. Eat protein, fat, and vegetables. Aim to include a variety of foods at each meal. · 2. Move your body Cardio workouts. Body Fat Real-Life Example: Zakaria's Progress Bonus Tip: About Scale Weight Online Coaching Conclusion. fat reserves get burned, you'll steadily shed the pounds. As you lose weight, your body will need less energy to sustain itself, so the number of calories. Losing 1 to 2 pounds a week is a healthier, more sustainable option—and it still requires a dedicated effort of eating around 1, fewer calories per day. You can expect to lose about 12 pounds maximum in six weeks. For most people, dropping any more weight in this amount of time is not possible or recommended. The actual amount of fat you can lose depends on many factors. For example, weight losses tend to be relative to body size. The more body fat you carry, the. body's potential to burn calories. Learn how to lose weight fast here If the individual does not use this sugar in fight or flight, the body will store it as. When it comes to general weight loss, the CDC (Centers for Disease Control and Prevention), recommends aiming for one to two pounds of weight loss per week. Losing 1 to 2 pounds a week is a healthier, more sustainable option—and it still requires a dedicated effort of eating around 1, fewer calories per day. pounds per week of fat loss is typical and it's still good general advice. · The more fat you have, the faster you can lose it; the leaner you are, the. You can lose one to two pounds of fat per week, but not much more than that. An increased energy deficit, beyond 1, calories per day, will lead to starvation. Experts recommend a moderate weight loss of 1–3 pounds (– kg) per week, or about 1% of your body weight. The bottom line. Weight. There is significant evidence that losing excess body fat is difficult for fat intake can aid in weight control. The mechanisms for weight loss on. In Australia, around 75% of men and 60% of women are carrying too much body fat and 25% of children are overweight or obese. You can lose body fat by making. People who are very overweight (men over 25% body fat and women over 35%) can often lose 2-to-4 pounds per week without issue. That means very overweight people. We Lost 22% Of Body Fat In 6 Weeks ; We Got A Six-Pack In 6 Weeks. BuzzFeed Video • ; We Lost 90 Pounds With A Celebrity Fitness Trainer. Pero Like • For example, a lb male with 15% body fat should aim to lose lbs per week. It is usually after weeks that you start to see the fat loss results. fat stores (6 to 8 pounds). Your recommended weight gain during pregnancy How much weight do you lose after pregnancy? Most women lose around Dieticians advise that if you eat calories less than your daily requirement you will lose about 1lb every seven days (expect some variation from person to. Over the first week or so, readily available energy stores (glycogen) are quickly depleted along with a lot of water. This can easily account for 2lbs or more.

How Hard Is It To Refinance Your House

With a new mortgage, you could secure a lower interest rate, change your loan term, and more · Some types of loans may have a six-month waiting period before you. Refinancing fees can be rolled into the loan and are easy to disguise. Unscrupulous lenders may offer you a great rate and no "out-of-pocket' expenses, while. If you are 15 years into a 30 year loan, you can refi to a 15 year and keep the exact same schedule (adjusted for your new rate). The above. Criteria for refinancing includes: · A credit score of at least for a conventional mortgage and a slightly lower score for an FHA loan. · A maximum loan-to-. Finally, although only temporary, refinancing your mortgage could have a negative impact on your credit score as the lender will perform a hard inquiry to. Two reasons refinancing will lower your credit score — and one action you can take to lessen the impact: · 1. Multiple hard inquiries: · 2. Old debt becomes “new”. This is because refinancing a mortgage can be time-consuming, expensive at closing, and will result in the lender pulling your credit score. Once it passes, your lender is free to disburse your loan proceeds. Loss of control: When your home is paid off, you call most of the shots. When a lender has. One of the best and most common reasons to refinance is to lower your loan's interest rate. Historically, the rule of thumb has been that refinancing is a good. With a new mortgage, you could secure a lower interest rate, change your loan term, and more · Some types of loans may have a six-month waiting period before you. Refinancing fees can be rolled into the loan and are easy to disguise. Unscrupulous lenders may offer you a great rate and no "out-of-pocket' expenses, while. If you are 15 years into a 30 year loan, you can refi to a 15 year and keep the exact same schedule (adjusted for your new rate). The above. Criteria for refinancing includes: · A credit score of at least for a conventional mortgage and a slightly lower score for an FHA loan. · A maximum loan-to-. Finally, although only temporary, refinancing your mortgage could have a negative impact on your credit score as the lender will perform a hard inquiry to. Two reasons refinancing will lower your credit score — and one action you can take to lessen the impact: · 1. Multiple hard inquiries: · 2. Old debt becomes “new”. This is because refinancing a mortgage can be time-consuming, expensive at closing, and will result in the lender pulling your credit score. Once it passes, your lender is free to disburse your loan proceeds. Loss of control: When your home is paid off, you call most of the shots. When a lender has. One of the best and most common reasons to refinance is to lower your loan's interest rate. Historically, the rule of thumb has been that refinancing is a good.

If your appraisal comes back lower than expected, you may not qualify to borrow as much home equity as you'd hoped. 3. Your lender finalizes your cash-out. Home equity loans and liens. It's more difficult to get approved for refinancing if you have a home equity loan or lien on your house. You'll probably need. Along with the new loan application paperwork you'll have to complete, your lender may require the title to be transferred into your name before refinancing. My property is in a trust, how does that work in a refinance? Trusts typically contain money or other financial assets (such as property) that are bound by. The most common reason why refinance loan applications are denied is because the borrower has too much debt. Because lenders have to make a good-faith effort to. you cant refinance if you are upside down on mortgage. so even if rates comes down, but your house price is alos down, you cant refinance. Apply for your mortgage. When a mortgage professional reviews your application, they'll do a hard pull on your credit in order to evaluate your worthiness. Mortgage refinancing is when a homeowner pays off their existing home loan with a new one that typically saves them money through a lower interest rate, a. Refinancing can help you take advantage of lower interest rates to save money on your monthly payments, use your equity to consolidate debt, or even shorten. New loan terms: When you refinance an existing mortgage, you are putting a new mortgage on your home. This new mortgage may have different terms and conditions. Many lenders will require at least a year of payments before refinancing your home. Some refuse to refinance in any situation within to days of issuing. FHA loans also include mortgage insurance premiums. Once you have 20% equity in your home, you may be able to refinance your FHA loan to a conventional loan. When refinancing your mortgage, you're replacing your existing mortgage with a new mortgage. Your new mortgage refinancing rate is partially based on your. Maybe you want to lower your monthly payment, change the loan term, get a lower interest rate, or tap into your home equity for other expenses. Similar to when you initially purchased your home, you will have to pay fees, taxes and closing costs on your refinance mortgage. It is important to determine. Determine if refinancing makes financial sense for you. · Shop around for the best rates and compare lenders. · Apply to refinance with your top choices. · Lock in. Mortgage refinancing is when you take out a new home loan to pay off an existing mortgage. If you refinance, you may be able to lock in a lower interest. Interest rates are at historic lows. If you're a homeowner, you may be looking to refinance your mortgage to lock in a lower fixed rate for 15 or 30 years. Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. Refinancing a mortgage is the process of taking out a new home loan and using that loan to pay down the balance on your original mortgage.

Solr Pricing

Pricing Information. Use this tool to estimate the software and infrastructure costs based on your configuration choices. Your usage and costs might be. Solr is the #8 ranked solution in top Search as a Service vendors. PeerSpot users give Solr an average rating of out of Solr is most commonly compared. With TrustRadius, learn about Apache Solr. With details to help you compare pricing plans, explore costs, discover free options, & so much more. Explore Apache Solr pricing, reviews, features and compare other top Site Search Software to Apache Solr on just-studio.ru The current price of RazrFi is PKR per SOLR. With a circulating supply of 0 SOLR, it means that RazrFi has a total market cap of PKR The amount of. Apache Solr Pricing: Basic & Enterprise Plans For Small, Medium and Large Businesses Billed Monthly & Yearly. Compare the cost with top Apache Solr. Please contact us with your requirements and we'll make you a custom offer. Hosted Solr. Features · Why Hosted Solr? Plans & Pricing. Social Media. Hosted Apache Solr shut down on October 31, Read this FAQ for more details. Cost-effective Apache Solr search hosting for Drupal. Elestio charges you on an hourly basis for the resources you use. Each resource has a credit cost per hour. From the dashboard, you can view your current. Pricing Information. Use this tool to estimate the software and infrastructure costs based on your configuration choices. Your usage and costs might be. Solr is the #8 ranked solution in top Search as a Service vendors. PeerSpot users give Solr an average rating of out of Solr is most commonly compared. With TrustRadius, learn about Apache Solr. With details to help you compare pricing plans, explore costs, discover free options, & so much more. Explore Apache Solr pricing, reviews, features and compare other top Site Search Software to Apache Solr on just-studio.ru The current price of RazrFi is PKR per SOLR. With a circulating supply of 0 SOLR, it means that RazrFi has a total market cap of PKR The amount of. Apache Solr Pricing: Basic & Enterprise Plans For Small, Medium and Large Businesses Billed Monthly & Yearly. Compare the cost with top Apache Solr. Please contact us with your requirements and we'll make you a custom offer. Hosted Solr. Features · Why Hosted Solr? Plans & Pricing. Social Media. Hosted Apache Solr shut down on October 31, Read this FAQ for more details. Cost-effective Apache Solr search hosting for Drupal. Elestio charges you on an hourly basis for the resources you use. Each resource has a credit cost per hour. From the dashboard, you can view your current.

The Average Cost of a basic Site Search Software plan is $15 per month. 51% of Site Search Software offer a Free Trial Allows users to try out the software for. Apache solr is one of the best in its category (open source), it has many features and from indexing to relevence search, it can be used for small to large. The Azul Platform optimizes Apache Solr to drive SLA-beating, infrastructure costs-saving, Java-based search experiences for websites, e-Commerce platforms. The price of RazrFi (SOLR) is calculated in real-time by aggregating the latest data across 2 exchanges and 3 markets, using a global volume-weighted average. Learn more about Apache Solr pricing, benefits, and disadvantages for your business in Canada. Read verified software reviews and find tools that fit your. In the online store example, the schema would define fields for the product name, description, price, manufacturer, and so on. Solr's schema is powerful and. Pricing Information. Below are the total costs for these different subscription durations. Additional taxes or fees may apply. SearchStax Solr Service. Units. Detailed reviews on Apache Solr based on features, pricing, usability, and ratings. Get a quick overview advantages and disadvantages. Compare Apache Solr. Solr is highly reliable, scalable and fault tolerant, providing distributed indexing, replication and load-balanced querying, automated failover and recovery. [/var/solr/logs/just-studio.ru], A list of filesystem paths to read by tailing Google Cloud pricing · Google Workspace pricing · See all products. Solutions. Try it first on your local/staging (no signup) €99/month Search with Algolia Cancel anytime *Algolia fees not included. Get the pricing details for SearchStax Managed Search - hosted managed Solr service available on Google Cloud, Microsoft Azure or AWS. Looking for hosted Solr pricing? Check out our Managed Search service ; Professional. Organizations That Want Better Search at an Affordable Price. $/month. Get 1 Year Free and unparalleled support, from our Solr experts, and enjoy our full featured Control Panel UI and the Opensolr API. Pricing Get 1 Year Free! Couchsurfing has your back, with a little help from us. Product. Status · Pricing · Terms · Privacy. Resources. Heroku Addon · Apache Solr · Solr Docs. Get Help. solr. Niles Partners Inc. Overview · Plans + Pricing · Ratings + reviews. Solr is the popular, blazing fast, NoSQL search platform from the Apache Lucene. The all-time high price of SolRazr (SOLR) is $ The current price of SOLR is down % from its all-time high. Are you not sure if AddSearch или Apache Solr is best for your business? Check out our service comparison to contrast prices and features. Working with Currencies and Exchange Rates · Point queries · Range queries · Function range queries · Sorting · Currency parsing by either currency code or. Solr is a standalone enterprise search server with a REST-like API. You put documents in it (called indexing) via JSON, XML, CSV or binary over HTTP.

How To Write A 30 60 90 Day Business Plan

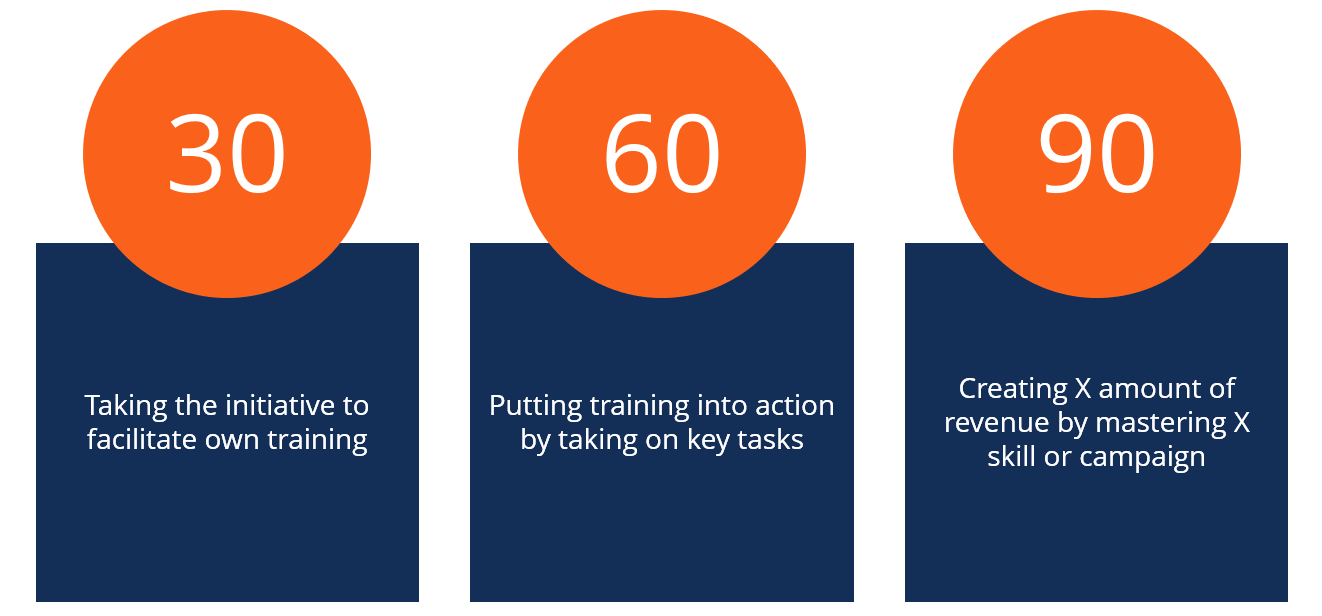

A day marketing plan lays out your path of action for the first three months on the job. The goal is to help you make a smooth transition by. A day plan is a strategic roadmap that outlines your intentions and goals for the first 30, 60, and 90 days of your new job. Key Steps for Writing an Effective Day Sales Plan · 1. Create an outline. Begin by sorting your ideas based on each day increment: · 2. Define your. Mar 9, - Explore Brian W Murphy's board "30/60/90 Day Plans" on Pinterest. See more ideas about 90 day plan, day plan, how to plan. Have you completed all required company training? Do you understand the high-level priorities for your company and team? What are the goals your company plans. The KPIs, goals, and milestones that you set in the previous 30 days? They'll start making headway on them. This is the part of the 30 60 90 day plan where each. Write me a 90 day action plan for a BDR position for the following job description; split it into 30, 60, and 90 days; split it again into weekly. What To Include In A Day Plan For Sales · Formal training · Mission, vision, and goals · Organizational structure · Benchmark external influencers. A day business plan is a written document that outlines the goals and actions that a new employee or a business owner will take. A day marketing plan lays out your path of action for the first three months on the job. The goal is to help you make a smooth transition by. A day plan is a strategic roadmap that outlines your intentions and goals for the first 30, 60, and 90 days of your new job. Key Steps for Writing an Effective Day Sales Plan · 1. Create an outline. Begin by sorting your ideas based on each day increment: · 2. Define your. Mar 9, - Explore Brian W Murphy's board "30/60/90 Day Plans" on Pinterest. See more ideas about 90 day plan, day plan, how to plan. Have you completed all required company training? Do you understand the high-level priorities for your company and team? What are the goals your company plans. The KPIs, goals, and milestones that you set in the previous 30 days? They'll start making headway on them. This is the part of the 30 60 90 day plan where each. Write me a 90 day action plan for a BDR position for the following job description; split it into 30, 60, and 90 days; split it again into weekly. What To Include In A Day Plan For Sales · Formal training · Mission, vision, and goals · Organizational structure · Benchmark external influencers. A day business plan is a written document that outlines the goals and actions that a new employee or a business owner will take.

The second situation where you'd write a day plan is during the first week of a new job. If you're the hiring manager, this plan will allow you to. 1. Define the goal you're working toward · 2. Determine strategies · 3. Balance technical, strategic, and production resources to form your tactical plan · 4. 6 tips for writing a day plan · 1. Think big picture. · 2. Ask questions. · 3. Meet with key stakeholders. · 4. Set SMART goals. · 5. Determine how you'll. A 30 60 90 day plan for managers is an outline that showcases what a new manager hopes to achieve in the first 30, 60, and 90 days in their new role. This helps to establish a shared understanding of expectations for your role, and clarifies short- and long-term goals. A broad template. Here's a. A day plan is a tool for new managers or managers new to their roles to gain clarity of what's expected from them. Day Plan · 1. Outline Your Goals. The first step is to decide on the goals you want to accomplish in the next days. · 2. Identify the Tasks. For. How To Create a Winning Day Sales Plan (+ Sales Plan Template) · Scenario 1: First Week on the Job · Scenario 2: New Territory Management Assignments. How to Create a Day Sales Plan · 1. Define the Company Mission · 2. Set day Objectives · 3. Set day and day Objectives · 4. Provide Ample. The focus of the first 30 days should be all about absorbing and learning about the business, environment, and team as much as possible. Spend time. A Day Plan is a written outline of your strategy, and the plans you have for the first three months on the job. SAMPLE DAY BUSINESS PLAN FOR STARTUP. PLAN TITLE. PREPARED BY. Startup Company Day Business Plan. Miguel Sanchez. PURPOSE. DATE. To establish. One trick is to create a day plan to show the hiring company how you'll run the team or territory if you were in charge. The most overwhelming part of being an outside sales rep is building a brand-new territory from scratch. Managing a territory is like running a business. So, whenever possible, the person writing the plan should find out the name of the software the company uses. Or, if they know the kind of orientation that new. 30 days. The first 30 days of the plan is about showing your eagerness to become an expert. · 60 days · 90 days · Details matter · In Conclusion. Within each phase of your day plan, provide a detailed action plan. Specify the tasks, activities, and milestones you need to achieve to progress to the next. A day onboarding plan is an action plan that helps guide new employees through the first 90 days in their new job. A day plan provides sales reps and managers with a strategic roadmap for their first 90 days in a new role. It is structured into 30 day phases, each. Create two versions: 30 60 90 day plan presentation. Summarise how you'll get up to speed in the role over the course of your first 3 months. Present your plan.

What Is E Commerce Company

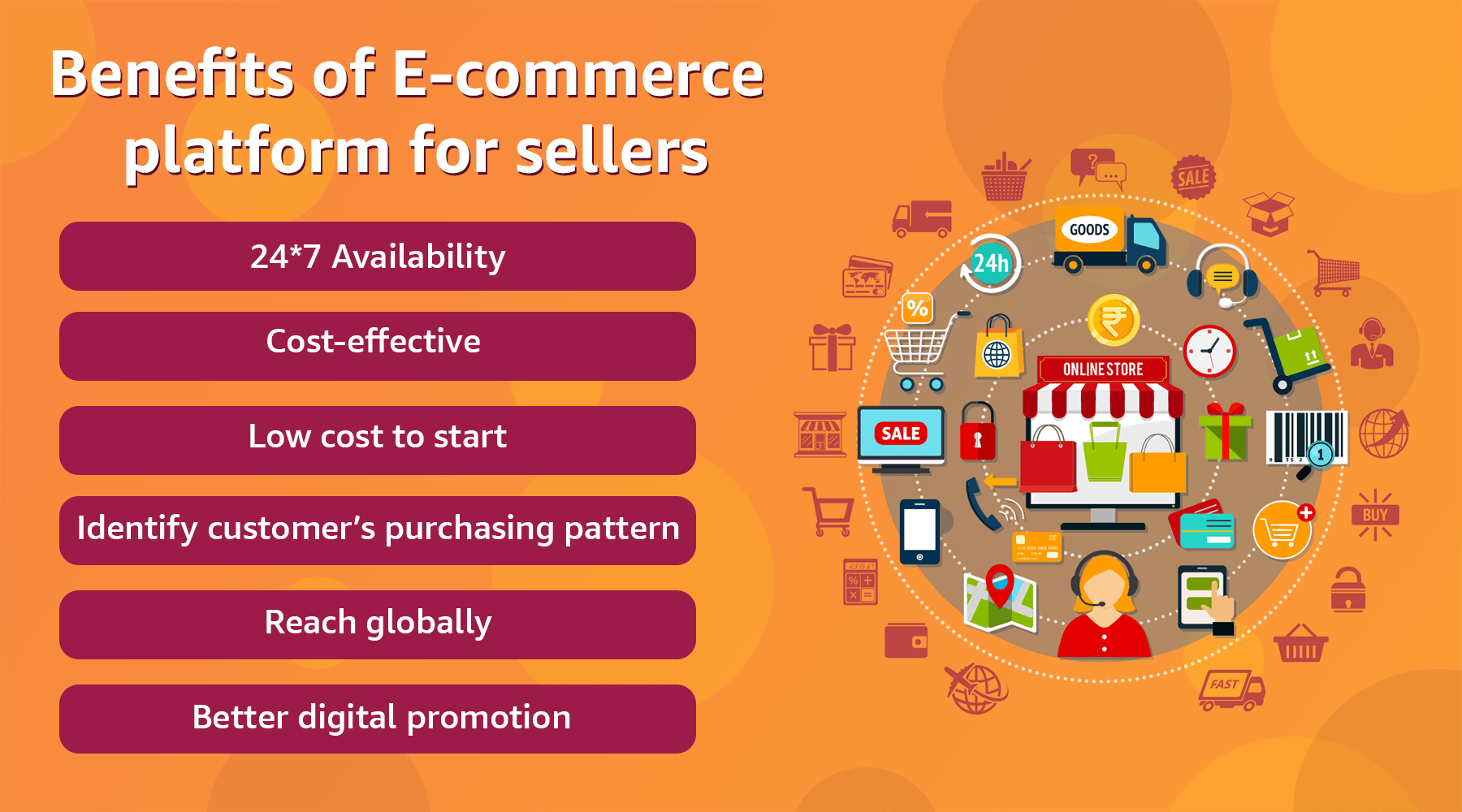

At its core, electronic commerce or e-commerce is simply the buying and selling of goods and services using the internet, when shopping online. However, the. E-Commerce or Electronic Commerce means buying and selling of goods, products, or services over the internet. E-commerce is also known as electronic. E-commerce is a business model that enables the buying and selling of goods and services over the internet. Another type of interaction between consumers and businesses is consumer-to-business. The transaction takes place on a website where customers buy products or. Advantages of E-commerce For a Business · #1 Lower Your Costs · #2 Use Affordable Marketing · #3 Collect Customer Data Insights · #4 Reach New Customers · #5 Make It. E-commerce involves online buying/selling and services like payment processing. Platforms like Amazon, Etsy, and Shopify offer various e-commerce business. E-commerce (electronic commerce) is the activity of electronically buying or selling products on online services or over the Internet. B2A (sometimes called B2G) is when a business sells its product or services to a government entity. For example, it could be a service company that provides. Ecommerce is the buying/selling of goods or services on the Internet. Learn more about what ecommerce is, its impact, history and where it's headed. At its core, electronic commerce or e-commerce is simply the buying and selling of goods and services using the internet, when shopping online. However, the. E-Commerce or Electronic Commerce means buying and selling of goods, products, or services over the internet. E-commerce is also known as electronic. E-commerce is a business model that enables the buying and selling of goods and services over the internet. Another type of interaction between consumers and businesses is consumer-to-business. The transaction takes place on a website where customers buy products or. Advantages of E-commerce For a Business · #1 Lower Your Costs · #2 Use Affordable Marketing · #3 Collect Customer Data Insights · #4 Reach New Customers · #5 Make It. E-commerce involves online buying/selling and services like payment processing. Platforms like Amazon, Etsy, and Shopify offer various e-commerce business. E-commerce (electronic commerce) is the activity of electronically buying or selling products on online services or over the Internet. B2A (sometimes called B2G) is when a business sells its product or services to a government entity. For example, it could be a service company that provides. Ecommerce is the buying/selling of goods or services on the Internet. Learn more about what ecommerce is, its impact, history and where it's headed.

The definition of eCommerce is simple: selling goods or services online. If you sell through your own company website, via marketplaces such as eBay or Amazon. It doesn't matter if your business is large or small, B2B or B2C, selling tangible goods or providing remote services. Companies need to meet their customers in. Consumer-to-business (C2B): C2B is when consumers sell their products to businesses using the internet. Business-to-administration (B2A): B2A e-commerce relates. E-Commerce is a type of business model that focuses on doing commercial transactions through electronic networks such as the Internet. E-commerce stands for. Ecommerce refers to when individuals or companies buy and sell goods or services online. Ecommerce can be carried out on a smartphone app or online store, on a. Business-to-Business (B2B) E-commerce. Not all businesses market to individual consumers. Some sell products and services to other companies. When that takes. Amazon — Born in as an online bookstore, this e-commerce titan generated $ million in revenue in its first year. It's since built up an online empire. What is e-commerce? E-commerce is the process of selling goods and services online. Customers come to the website or online marketplace and purchase products. eCommerce has become a term that covers everything a business does online to sell to consumers, both domestically and overseas. It includes: the sale through a. Business-to consumer (B2C) e-commerce describes sales operations where the buyers are an individual end-user. It is synonymous of e-retail. Consumer-to-consumer. An ecommerce business sells products or services to customers over the internet. Ecommerce businesses can range from small, home-based operations to large. B2B ecommerce refers to selling products or services to businesses. B2B companies typically have a higher order value and more recurring purchases. B2B. E-Commerce Companies to Know · Klaviyo · The Black Tux · Sunday · AWeber · Jabra Hearing · Cin7 · Rokt · Reverb · View Profile · We are hiring. E-commerce, maintaining relationships and conducting business transactions that include selling information, services, and goods by means of computer. Stores Selling Physical Goods. These merchants follow the typical online retail business model. From swimsuits to sportswear and office equipment, shoppers can. Ecommerce management is the practice of maintaining an online business. Generally speaking, ecommerce management aims to help brands reach their goals for. Electronic business · Electronic business (also known as online business or e-business) is any kind of business or commercial transaction that includes sharing. Business-to-Business (B2B) · Business-to-Consumer (B2C) · Consumer-to-Consumer (C2C) · Consumer-to-Business (C2B). · Business-to-Administration (B2A) · Consumer-to-. A series of software technologies that are integrated into a business's website that allows a business to solicit products or services from their website to. Critical business systems are connected to critical constituencies—customers, vendors, and suppliers—via the Internet, extranets, and intranets. No revenue is.

Gross Up Payroll Formula

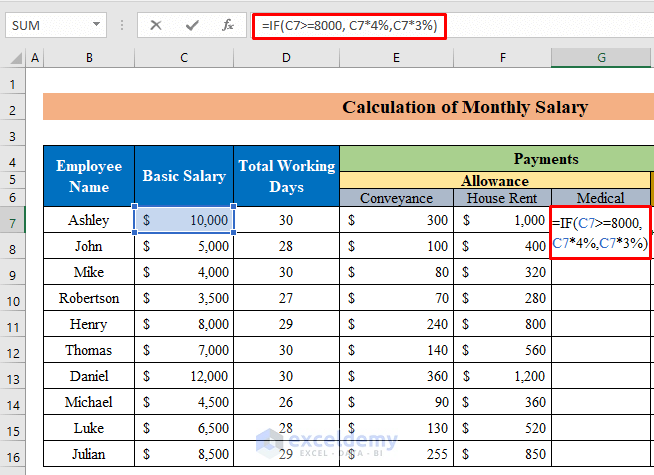

Calculating Gross-up · % – tax% (federal/state/local taxes) = Net% · Payment / Net% = Gross amount of earnings · Check by calculating gross to net pay. Use the Hourly Paycheck Calculator to find out what take-home wages are every pay period for hourly employees. Gross-Up Payroll Calculator. $10/mo + $5 per. Gross Up Amount: This is an estimated amount that the department needs to pay that will show on the employee's check before withholdings. Find out how much your gross pay should be for a specific take-home pay. Calculate the gross wages based on a net pay amount. Use the Gross-Up. Gross-Up. Your Calculation, Example. 1, Annual gross taxable wages, $52, 2, Number of paychecks per year, 3, Divide line 1 by line 2. This is wages per paycheck. Gross-up Formula: This equation takes the intended net pay and divides it by one minus the tax rate to determine the gross amount needed. Gross-Up in Action. Use this gross up calculator to determine the take home or net amount based on gross pay. Perfect for any net to gross pay calculations. Gross-up is a term referring to payments (such as bonuses and salaries) with built-in deduction and tax compensation. To gross-up a payment, you offer more. The tax is charged on the gross amount of £ (x 20% = £25 tax). This is why the calculation is to DIVIDE BY (1 – tax rate) to give the right answer of £/(1. Calculating Gross-up · % – tax% (federal/state/local taxes) = Net% · Payment / Net% = Gross amount of earnings · Check by calculating gross to net pay. Use the Hourly Paycheck Calculator to find out what take-home wages are every pay period for hourly employees. Gross-Up Payroll Calculator. $10/mo + $5 per. Gross Up Amount: This is an estimated amount that the department needs to pay that will show on the employee's check before withholdings. Find out how much your gross pay should be for a specific take-home pay. Calculate the gross wages based on a net pay amount. Use the Gross-Up. Gross-Up. Your Calculation, Example. 1, Annual gross taxable wages, $52, 2, Number of paychecks per year, 3, Divide line 1 by line 2. This is wages per paycheck. Gross-up Formula: This equation takes the intended net pay and divides it by one minus the tax rate to determine the gross amount needed. Gross-Up in Action. Use this gross up calculator to determine the take home or net amount based on gross pay. Perfect for any net to gross pay calculations. Gross-up is a term referring to payments (such as bonuses and salaries) with built-in deduction and tax compensation. To gross-up a payment, you offer more. The tax is charged on the gross amount of £ (x 20% = £25 tax). This is why the calculation is to DIVIDE BY (1 – tax rate) to give the right answer of £/(1.

After calculating a hypothetical pay check or the pre-determined amount of a gross-up calculation, you can view the transactions that will create this check and. A payroll gross-up is when a business pays an employee an increased amount to offset the cost of the employee's payroll taxes. So if you promise to pay a $1, Grossed-up monthly taxable income = (Monthly taxable income subject to gross up – quick deduction B) / ( percent – applicable tax rate B) Monthly tax. Gross-up is defined as "an IRS-approved formula that employers can use to gross payment when the employer wishes to pay the employee's share of tax.". Gross-up pay works by dividing the employee's wages by the net percentage of taxes that would be due. The total equals the gross-up pay amount. All regulations. Unemployment Insurance (UI) tax and Employment Training Tax (ETT) are calculated up to the UI taxable wage limit of each employee's wages per year and are paid. Gross Up Calculator Gross pay vs. net pay: What's the difference? Get 3 months free* when you sign up for payroll processing today. Start Quote. * See the. You may want to pay your employee an exact net (or take home) pay amount. This is referred to as a gross up paycheck, and is most common with bonuses. When you. Net to gross calculation payments are when you want to pay an employee a fixed net amount that takes into account any tax, NI, pension, and student loan. up to claim code Based on the example above, to calculate the non Gross commission amount including gross salary at the time of payment, plus. Gross Up Formulas · Divide the Desired Net Amount by if the employee has not met his/her OASDI Maximum for the calendar year. · Divide the Desired Net. When paying supplemental compensation, such as a bonus or a relocation payment, payroll taxes must be paid. The formula used to calculate a gross-up is: Gross. Gross-Up Steps. These are the basic steps in running a gross-up: Add a Paysheet page. Enter tax overrides. Enter deduction overrides. Run the Pay Calculation. Grossing up · A process to calculate the gross amount of a payment (that is, the before-tax value of a payment) where only the net amount (that is, the after-tax. Also known as a net-to-gross calculation, a gross-up calculator lets you enter a net pay (aka your take-home pay after taxes) and calculate how much gross pay. Definitions · Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage. · Subtracting the value of allowances allowed . The premium rate is percent of each employee's gross wages, not including tips, up to the Social Security cap ($,). Employers can withhold. The element's payroll formula runs. This formula: Adds the additional amount Set Up Payroll Processing Rules. FAQs for Elements. 13 Set Up Costing. Purpose: To outline the process and guidelines for using the net calculations method on PHAADJT. Target Audience: MAU Payroll. The gross up net calculation.

17c Formula

The damage multiplier institutes a diminished value step formula that categorizes different types of damage and weighs them against a vehicle's milage using the. Most carriers will use the 17c diminished value formula. This formula allows insurance companies to calculate a vehicle's new value after an accident. The. Insurance companies use the 17c formula to pay your diminished value claim, it consists of 3 parts, base LOV, mileage adjustment and damage modifier% of. The Insurance Company Formula. A lot of insurance companies use the 17c formula. It works like this: First, the insurance companies start with the NADA Used Car. This loss in value is known as Diminished Value or DV. The above case was settled and the parties agreed to the use of a “formula” referred to as the “17C. You can calculate the estimated DV by using the 17c formula. See calculation in the policy documents. A Subaru holds its value very. This is the 17c worksheet used by most insurance carriers to assess loss in value. The first component of 17c is called Base Loss in Value. 17C Diminished Value Calculation Formula: Unfair Appraisals. Fraction Valuations of Totaled Vehicles. The 17c Formula is by definition a fraction or. 17c takes the retail value of the car from step one and multiplies is by to produce the “base loss of value”. What this translates to is an automatic 10%. The damage multiplier institutes a diminished value step formula that categorizes different types of damage and weighs them against a vehicle's milage using the. Most carriers will use the 17c diminished value formula. This formula allows insurance companies to calculate a vehicle's new value after an accident. The. Insurance companies use the 17c formula to pay your diminished value claim, it consists of 3 parts, base LOV, mileage adjustment and damage modifier% of. The Insurance Company Formula. A lot of insurance companies use the 17c formula. It works like this: First, the insurance companies start with the NADA Used Car. This loss in value is known as Diminished Value or DV. The above case was settled and the parties agreed to the use of a “formula” referred to as the “17C. You can calculate the estimated DV by using the 17c formula. See calculation in the policy documents. A Subaru holds its value very. This is the 17c worksheet used by most insurance carriers to assess loss in value. The first component of 17c is called Base Loss in Value. 17C Diminished Value Calculation Formula: Unfair Appraisals. Fraction Valuations of Totaled Vehicles. The 17c Formula is by definition a fraction or. 17c takes the retail value of the car from step one and multiplies is by to produce the “base loss of value”. What this translates to is an automatic 10%.

Rule 17c was created by the insurance industry and when applied you will immediately notice a factor used that has no basis and limits the formula from value. Insurance companies, in contract, use a very exact formula for calculating diminished value. This calculation is known as "17c" and has been adopted by many. 17C Formula. This refers to an overly simplistic calculation of diminished value that many insurance companies attempt to use to minimize their payout under. formula known as “The 17(c) Formula.” State Farm sampled thousands of claims from the class to determine the best of many formulas available at that time. Conclusion: The 17c formula underestimates the amount of diminishment, thereby cheating vehicle owners of the compensation they justly deserve. look at georgia's 17c formula. georgia is widely considered the most consumer friendly DV state, and their laws won't apply to your claim. 17c Formula eBook - Diminished Value Claims - Free download as PDF File .pdf), Text File .txt) or view presentation slides online. With no industry-wide way of calculating diminished value, insurance companies generally won't provide the formula they use. But most insurers follow the 17C. While there is no universal decreased value calculation, insurers often employ the 17c formula or a modified version of it. The processes for calculating. Car insurance companies rely on the 17c formula to help determine what the difference is between a car's pre-accident value and its value after an accident and. The 17C formula attempts to place an arbitrary 10% cap on the diminished value claim. When dealing with car accident claims there are many pitfalls, which may. 17c Formula Diminished Value - Free download as PDF File .pdf), Text File .txt) or read online for free. This ebook's mission is to shed the light on 17c. Instructional Worksheet. A, B, C, D, E, F. 1, INSTRUCTIONS - EXAMPLE. 2. 3, Georgia Diminished Value Calculation Worksheet (based on 17C Formula Calculation). Diminished value appraisal Formula 17c. The insurance company is likely to Learn what you can about the 17c formula. Identify areas of dispute with. The most widely accepted method for calculating diminished value is the 17c formula. Most insurance providers favor this method, but keep in mind that it's. Last year we marked the 17th anniversary of the State Farm v Mabry case that gave the world of diminished value the 17c Formula with a blog post that described. Typically, the 17c formula pays pennies to the dollar of what is really owed to consumers for Diminished Value. If you are a resident of Georgia give Expert. Insurance companies use something known as the "17c formula" to calculate diminished value. If the insurance company makes you an offer based on the 17c formula. Insurance companies usually use the 17c Formula to calculate diminished value. However, insurance providers use this formula to lower offers. In response, insurance companies in Georgia have attempted to utilize a Diminished Value formula referred to as “Rule 17c.” Rule 17c is actually a fallback.

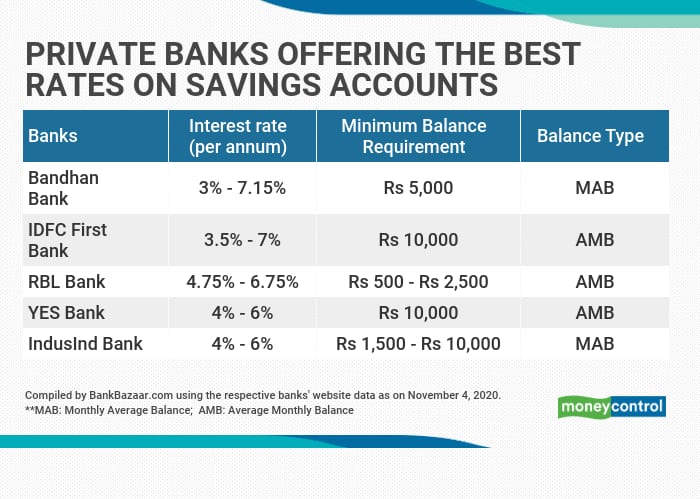

Current Bank Incentives

Member FDIC. Enjoy a $ bonus when you open a new Everyday checking account with qualifying electronic deposits. Get up to $ when you open a new Basic Business Checking account and establish a new payment processing account. Enjoy your bonus $ for Perks Checking¶ or $ for Platinum Perks Checking¶ will be deposited in your new account within 14 days of meeting requirements. Earn $ Bonus will be paid on or before days after account opening. Step 1 Open a TD Complete Checking account. Step 2. Earn a bonus up to $ Open a new Bank Smartly® Checking account and complete required activities. Offer valid through September Terms and limitations. One of the quickest ways to make some extra cash is to take advantage of the very competitive current account market and get a switching bonus. Earn up to a $ bonus when you open a new, eligible US Bank business checking account online with promo code Q3AFL24 and complete qualifying activities. Enjoy $ as a new Chase checking customer, when you open a Chase Total Checking account 1 and make direct deposits totaling $ or more within 90 days of. To qualify for the $ checking bonus, provide the offer code, open a Fifth Third Momentum® Checking, or Preferred2 checking account by 9/30/ and make. Member FDIC. Enjoy a $ bonus when you open a new Everyday checking account with qualifying electronic deposits. Get up to $ when you open a new Basic Business Checking account and establish a new payment processing account. Enjoy your bonus $ for Perks Checking¶ or $ for Platinum Perks Checking¶ will be deposited in your new account within 14 days of meeting requirements. Earn $ Bonus will be paid on or before days after account opening. Step 1 Open a TD Complete Checking account. Step 2. Earn a bonus up to $ Open a new Bank Smartly® Checking account and complete required activities. Offer valid through September Terms and limitations. One of the quickest ways to make some extra cash is to take advantage of the very competitive current account market and get a switching bonus. Earn up to a $ bonus when you open a new, eligible US Bank business checking account online with promo code Q3AFL24 and complete qualifying activities. Enjoy $ as a new Chase checking customer, when you open a Chase Total Checking account 1 and make direct deposits totaling $ or more within 90 days of. To qualify for the $ checking bonus, provide the offer code, open a Fifth Third Momentum® Checking, or Preferred2 checking account by 9/30/ and make.

For the Personal Account, Joint Account and EQ Bank Card, the current base interest rate is % (the “Base Rate”). Please review the EQ Bank Bonus Interest. Find the checking account that best fits your requirements. Take advantage of this bonus offer by completing three simple steps as a new personal checking. Earn up to a $ cash bonus when you open a new SoFi Checking and Savings account online with direct deposit. Take advantage of this promotion today! Find current bank account bonus offers from Citibank. Learn about time-limited offers for checking account bonuses, savings account bonuses and more. SoFi offers up to a $ bonus for any new customer opening a Better Online Bank Account who can put at least $5, of direct deposits into the account within. JPMorgan Chase Bank is currently offering a bonus of $ when you open a personal checking account and $ when you open a savings account. Get a $ cash bonus when you open a new Relationship Checking account and have a cumulative total of $7, in qualifying direct deposits within 90 days of. New personal checking customers can get a $ cash bonus after opening an account and receiving a qualifying direct deposit within 90 days of account opening. Earn up to a $ cash bonus. Your cash bonus will be awarded within 90 days after completing the qualifying direct deposits. Open a new eligible Bank of America business checking account and qualify for a $ cash bonus offer Access to powerful digital tools and Small Business. Receive up to a $ bonus with required minimum opening deposit (Associated Access Checking: $25, Associated Balanced or Choice Checking: $) and recurring. Some of the bonuses in your guide specify specific services for DDs. For example, for Current bank, you specify using Wise. In that. Receive the $ bonus: Keep your checking account open for at least 90 days. Huntington Bank will deposit the bonus into your new account within two weeks of. Our best current account switch offers · Switch Incentive: £ to switch and £90 to stay. · Interest rate: 0% AER interest on in-credit balances · Overdraft. To receive the bonus: Open a U.S. Bank Smartly Checking account by September 26, Within 90 days of account opening, enroll in online banking or get the. Score an easy New student checking customers can earn a $ bonus with qualifying activities. Get offer. Banks and other financial institutions are just like other businesses: They'll offer promotions to attract more business. Except instead of getting 25% off all. Bank smarter with MIDFLORIDA's limited-time $ cash bonus. Discover how simple it is to qualify for a Free Checking account that offers a wealth of benefits. New account holders can earn hundreds when signing up for these checking accounts. To attract new customers, many banks will often offer a sign-up bonus when. If you're new to bank account bonuses then this is where you should start, a A list of the best current sign up bonuses for deposit accounts.

Forex Locations

Find the OANDA office address. We are a leader in currency data, offering forex and CFD trading, corporate FX payments and exchange rates services. Best foreign exchange rates in Victoria. Please call or email [email protected]; 3 locations in Victoria & Vancouver. The most expensive, yet most convenient and easily accessible, spots to exchange money include train stations, airports, hotels and tourist areas. 8; 9; 10; ICE Currency Exchange. Banking & Currency. 11 Locations. Domestic BC's only hour currency exchange, ICE Currency Services offers foreign. Vancouver Bullion & Currency Exchange. VBCE specializes in Foreign Currency Be the first to hear about stores, special offers, contests, giveaways. Take your next trip with ease by ordering your foreign currency online or at one of our branches. Get details on foreign currency exchange rates and more. Order 55+ foreign currencies online or in person at any TD Bank location and pick up within 2–3 business days · Exchange foreign currency for U.S. dollars when. Check key currency exchange websites first. The following are some of the best and least expensive places to convert currency: Local banks and. Exchange currency at any of our 1, branches, including more than 50 locations with the most popular currencies on site and available same day. Not a Fifth. Find the OANDA office address. We are a leader in currency data, offering forex and CFD trading, corporate FX payments and exchange rates services. Best foreign exchange rates in Victoria. Please call or email [email protected]; 3 locations in Victoria & Vancouver. The most expensive, yet most convenient and easily accessible, spots to exchange money include train stations, airports, hotels and tourist areas. 8; 9; 10; ICE Currency Exchange. Banking & Currency. 11 Locations. Domestic BC's only hour currency exchange, ICE Currency Services offers foreign. Vancouver Bullion & Currency Exchange. VBCE specializes in Foreign Currency Be the first to hear about stores, special offers, contests, giveaways. Take your next trip with ease by ordering your foreign currency online or at one of our branches. Get details on foreign currency exchange rates and more. Order 55+ foreign currencies online or in person at any TD Bank location and pick up within 2–3 business days · Exchange foreign currency for U.S. dollars when. Check key currency exchange websites first. The following are some of the best and least expensive places to convert currency: Local banks and. Exchange currency at any of our 1, branches, including more than 50 locations with the most popular currencies on site and available same day. Not a Fifth.

Find the West Suburban Currency Exchange Locations near you. We offer the fast, friendly currency exchange service that you deserve. Our branches no longer have foreign currency cash on-hand available for over-the-counter same-day purchase, and we no longer can take foreign currency cash. Currency Exchange International offers a convenient, quick, and safe network of locations to exchange foreign travel money. Store Locations · Customer Feedback · Directory. Celebrating 30 Years in Business. Competitive Rates. No Commission. Last Updated: AM (PDT). Our account holders can order foreign currency online or exchange foreign currency at a financial center. Learn more about our foreign currency exchange. You'll find our unique orange branches at major airports, railway stations, department stores and prime tourist locations. Currency Exchange. Most of. Avoid foreign exchange outlets and save on currency fees with BMO foreign currency Locations |; Contact us. Welcome to BMO Financial Group's Canadian website. Our branches no longer have foreign currency cash on-hand available for over-the-counter same-day purchase, and we no longer can take foreign currency cash. Currency Exchange and Locations · ATMs are located throughout the airport and Canvas Credit Union is located in Jeppesen Terminal, Level 6. · Stay Connected! Sign. Competitive Exchange Rates, Personalized Assistance, and 24/7 Access ATMs Help You Get the Cash You Need · Dual Currency · ATM Banking · Currency Center · Location. More than 70 currencies are available at competitive exchange rates. Exchange currency at any of our 1, branches, including more than 50 locations with the. You can visit any one of our plus International Banking Center (IBC) branches. These maintain inventory of at least three major currencies, and may carry. Locations · Contact Us. close. ONLINE BANKING. Personal; Foreign Currency Exchange. Foreign Currency Exchange. Having foreign currency available from the start. Check key currency exchange websites first. The following are some of the best and least expensive places to convert currency: Local banks and. Trade FX safely on our trusted venues. Our technology and breadth of experience support your trading and reporting activities in this changing marketplace. exchange currency, Washington Dulles International Airport has multiple International Currency Exchange locations that can assist you. Locations. CXI aims to provide the Manhattan, New York City area with the best foreign currency exchange experience to all clients. Distance, Address, Hours. No financial centers found. Locations · Contact Us · Help & Support; Browse with Specialist; Accessible Banking · Privacy. Foreign Currency Exchange: See Commerce Bank branch locations that carry select foreign currency. Any location can order currency as needed. Locations To navigate, press the arrow keys.

Maximum Contribution To Roth 401k

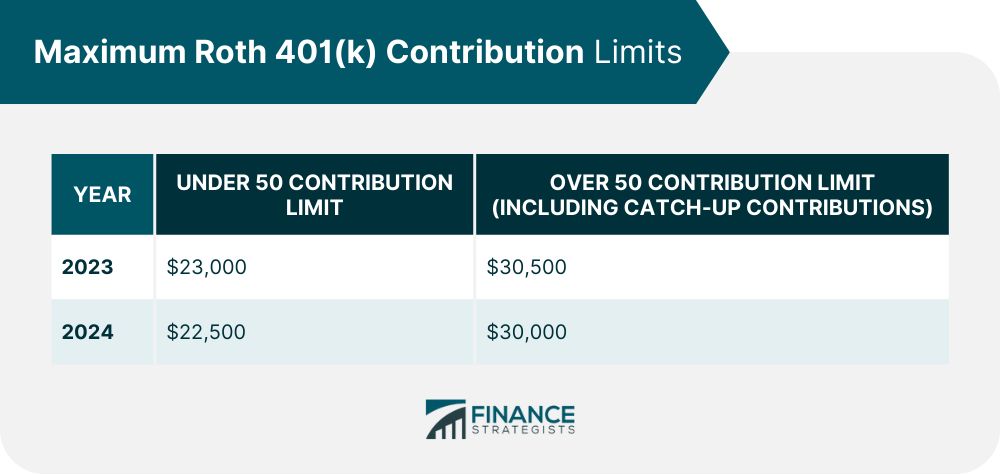

You make Roth (k) contributions with money that has already been taxed—just as you would with a Roth individual retirement account (IRA). Any earnings then. Roth vs. traditional: How do they compare? · In , the limit is $23,; for those over age 50, it's $30, · If you're eligible to contribute to both a (k). In , the most you can contribute to a Roth (k) and contribute in pretax contributions to a traditional (k) is $22, In , this rises to $23, The maximum amount you may contribute to the State of Michigan (k) Plan, including both pre-tax contributions and Roth contributions, is $18, for If. The annual maximum for is $23, If you are age 50 or over, a 'catch-up' provision allows you to contribute an additional $7, into your account. The. Cons · Lower contribution limits: The contribution limits of Roth IRAs are considerably lower than those of Roth (k)s. · Income limit for contributions: Roth. For , employees can contribute the $22, standard contribution limit to a Roth (k) and an additional $7, catch-up limit for those 50 and older. The. Your combined contributions, though, can't exceed the annual $23, limit or $30, maximum for workers 50 or older during the calendar year. Comparing. Roth (k) contributions are irrevocable; once money is invested into a Roth (k) account, it cannot be moved to a regular (k) account. · Employees can. You make Roth (k) contributions with money that has already been taxed—just as you would with a Roth individual retirement account (IRA). Any earnings then. Roth vs. traditional: How do they compare? · In , the limit is $23,; for those over age 50, it's $30, · If you're eligible to contribute to both a (k). In , the most you can contribute to a Roth (k) and contribute in pretax contributions to a traditional (k) is $22, In , this rises to $23, The maximum amount you may contribute to the State of Michigan (k) Plan, including both pre-tax contributions and Roth contributions, is $18, for If. The annual maximum for is $23, If you are age 50 or over, a 'catch-up' provision allows you to contribute an additional $7, into your account. The. Cons · Lower contribution limits: The contribution limits of Roth IRAs are considerably lower than those of Roth (k)s. · Income limit for contributions: Roth. For , employees can contribute the $22, standard contribution limit to a Roth (k) and an additional $7, catch-up limit for those 50 and older. The. Your combined contributions, though, can't exceed the annual $23, limit or $30, maximum for workers 50 or older during the calendar year. Comparing. Roth (k) contributions are irrevocable; once money is invested into a Roth (k) account, it cannot be moved to a regular (k) account. · Employees can.

Roth (k) contributions are irrevocable; once money is invested into a Roth (k) account, it cannot be moved to a regular (k) account. · Employees can. In addition, Roth (k) accounts are subject to the contribution limits of traditional in calculating maximum loan amounts. Page 6. Sample Decision. subject to certain contribution limits. just-studio.ru are the contribution limits for a Roth (k) account? A. In , the total annual contribution limit for. Elective salary deferrals (employee contributions–$22, for ; for the employee elective deferral limit increased to $23,) · Catch-up contributions. The contribution limit for a designated Roth (k) increased $ to $23, for Accountholders aged 50 or older may make additional catch-up. CONTRIBUTION LIMIT. $23, $7, CATCH-UP CONTRIBUTION. $7, $1, AFTER TAX CONTRIBUTION. Yes. Yes. (k) PLAN PREREQUISITE. Yes. No. EMPLOYER MATCH. Is there a limit on how much I may defer? For , the Roth (k) deferral limit is $20, ($26, if you are allowed to make catch-up contributions), the. For (k) accounts, the contribution limit is $, or $ for employees over For traditional and Roth IRA plans, the limit is $ A Roth (k) is an employer-sponsored plan and offers higher contribution limits. A Roth IRA, on the other hand, caps contributions far lower—up to $6, in. Individuals earning over $, ($,, if married) are not eligible to make Roth IRA contributions. However, Roth (k)s are not subject to these income. The contribution limits for a traditional (k) apply to a Roth (k). For , the maximum an individual can contribute to their (k) accounts is $20, Both the contributions you make on a pre-tax basis and on a Roth contribution basis will count towards this maximum. is made up of Roth (k) contributions. Contribution limits for (k) plans ; , ; Employee pre-tax and Roth contributions · $22,, $23, ; Maximum annual contributions · $66,, $69, ; Age. Plus, a Roth (k) has a higher contribution limit than a Roth IRA, so you could stash up to $23, (or $30,, if you're 50 or older) in individual. The limit is $17, in , plus an additional $5, in catch-up contributions if the participant will be age 50 or older at the end of the year. Age The current annual contribution limit is $19, You can contribute to a traditional and a Roth (k) and split the contributions in whatever way you wish, as. Roth plans are subject to contribution limits, and, in , the maximum is $19, What Is the Difference Between a Traditional (k) and Roth (k)?. Separately, IRA limits increased $ to $7,; IRA catch-up limits remain unchanged. The Total Amount You Can Defer Into a (k) is Increased to $69, For , employees can contribute the $22, standard contribution limit to a Roth (k) and an additional $7, catch-up limit for those 50 and older. The. For (k) accounts, the contribution limit is $, or $ for employees over For traditional and Roth IRA plans, the limit is $